Life Insurance Policy Entire Life Insurance Policy Utilizes Insurance Coverage Your Entire Life, As Long As You Pay Your Prices.

Life Insurance Policy. After The End Of The Level Premium Period.

SELAMAT MEMBACA!

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

A policy that provides a death benefit but also has the potential to.

A life insurance policy can help you give your family financial peace of mind if you are no longer there to provide for them.

A permanent life insurance policy, which includes whole life insurance and universal life permanent life insurance policies are designed to cover you until your death.

It has a monetary value that can serve as a savings account.

A term life policy is exactly what the name implies:

Coverage for a specific term or length of time, typically between 10 and 30 years.

Life insurance policies can provide financial security by replacing lost income and covering expenses.

If you're looking for a life insurance policy, we've got you covered.

Finding a fantastic life insurance policy and getting the cheapest rates for life insurance plans can save people a lot of money throughout their lives on this great protection.

After the end of the level premium period.

Life insurance policies help provide security to either you or your beneficiaries after you pass away or after a designated period of time.

With a life insurance policy from nationwide.

Learn about the different types of life insurance coverage to help you narrow your policy options.

Beneficiaries of an individual life insurance policy (not purchased through an employer) can visit if your employer offers life insurance, find out what options may be available to you.

Fifty years ago, most life insurance policies sold were guaranteed and offered by mutual fund companies.

How long do i need cover?

Life insurance can help your loved ones with financial obligations in the case of your death.

The policy or its provisions may vary or be unavailable in some states.

However, the benefits are distributed proportionally over a period, and not in one go at the end of policy term.

Life insurance coverage to last a lifetime.

Allianz offers fixed index universal life (fiul) insurance, a type of permanent insurance that offers a death benefit for as long as your policy remains in force.

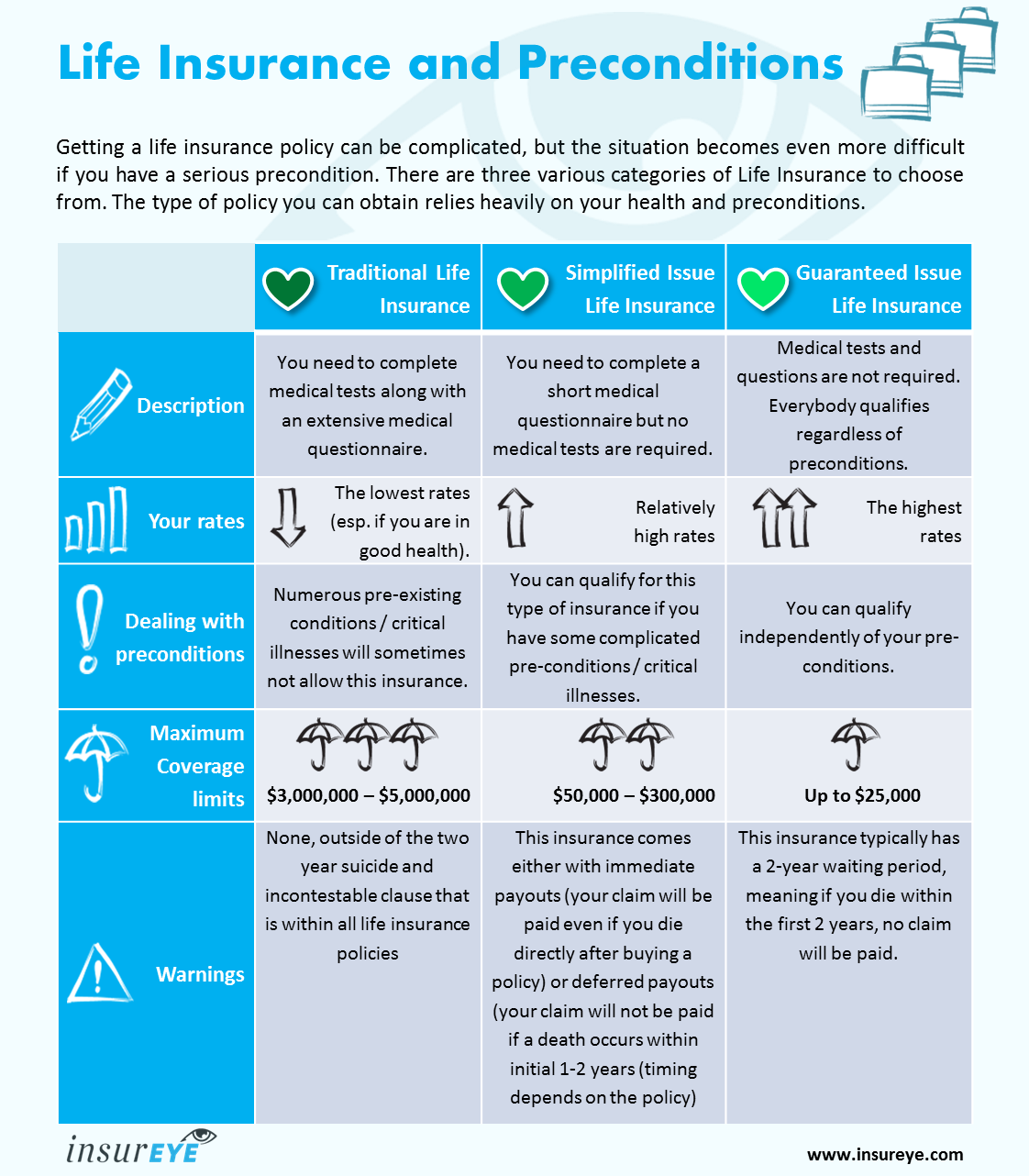

Guaranteed issue policies however, limit the amount of insurance often to $50,000 or possibly $100.

An endowment life insurance policy is a college savings vehicle.

Think of it as an alternative to a 529 college savings plan, or to keeping cash savings.

M purchases a $70,000 life insurance policy with premium payments of $550 a year for the first 5 years.

At the beginning of the sixth year, the premium will increase to $800 per year but will remain.

A whole life insurance policy offers life insurance coverage for the whole life of the insured individual.

A life insurance policy refers to the contract between an insurance provider and an individual [1].

As per the agreement, the policyholders pay a certain amount as the policy premium while the insurer.

As life changes, insurance needs can change too.

Financially protect your loved ones with life insurance.

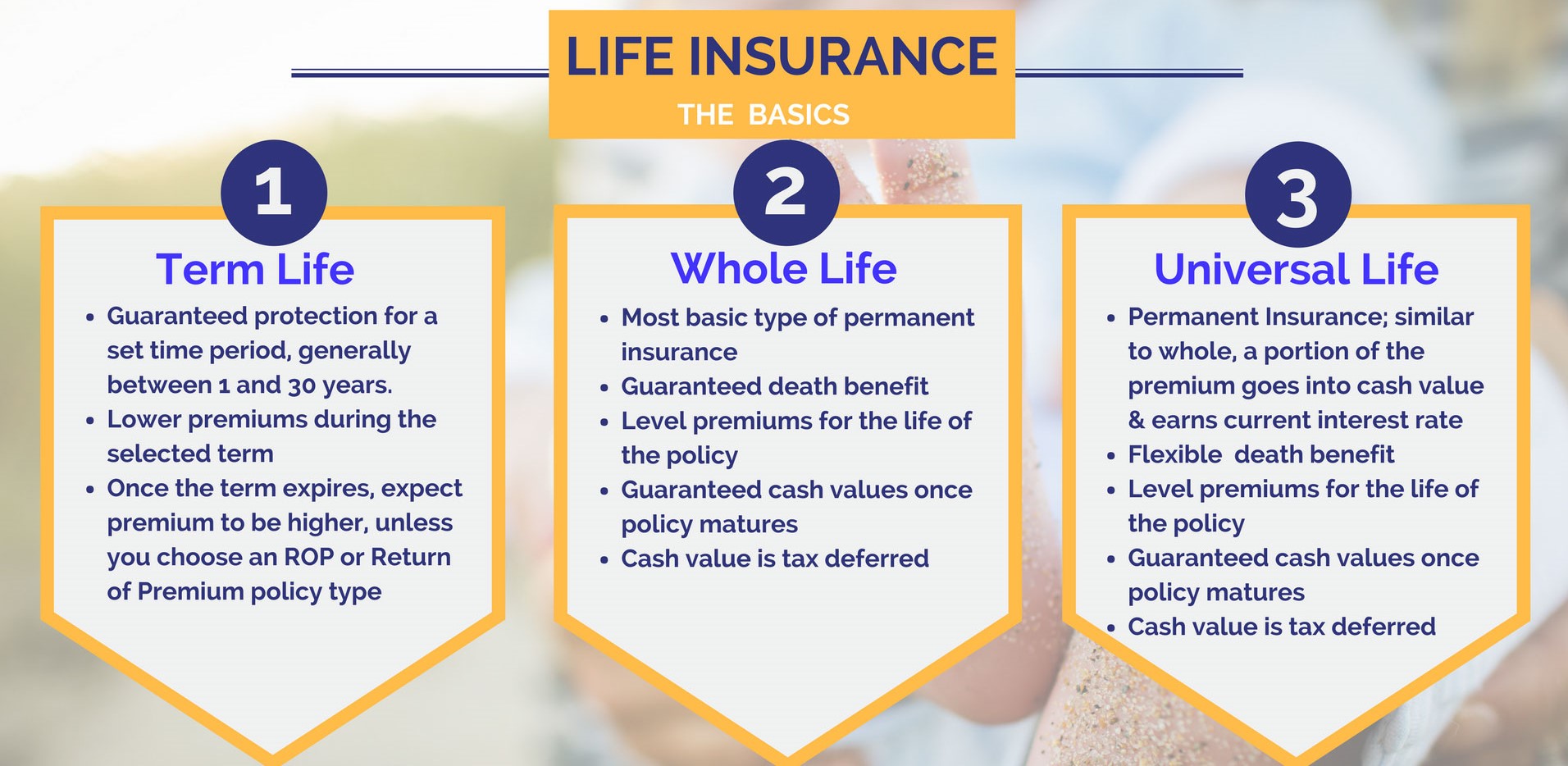

You have options to choose from, including term life insurance, permanent life insurance and universal life insurance.

Choose from a range of life insurance plans from hdfc life that best suits your.

Understand & buy various life insurance plans online in india.

Life insurance is meant to help your family avoid financial hardship if you die.

But being stuck with the wrong policy, or a policy you no longer need, could cause plenty of problems while you're alive.

A lump sum amount is paid by the insurance company in the form of insurance.

Obat Hebat, Si Sisik NagaMengusir Komedo Membandel - Bagian 2Awas!! Ini Bahaya Pewarna Kimia Pada Makanan5 Olahan Jahe Bikin SehatManfaat Kunyah Makanan 33 KaliTernyata Tidur Bisa Buat MeninggalFakta Salah Kafein KopiTernyata Einstein Sering Lupa Kunci Motor4 Manfaat Minum Jus Tomat Sebelum Tidur5 Manfaat Meredam Kaki Di Air EsLife insurance is a financial product, wherein the policy holder and the life insurance company comes to an agreement. Life Insurance Policy. A lump sum amount is paid by the insurance company in the form of insurance.

Beispielsätze für life insurance policy auf deutsch.

/life-ins-56a634e05f9b58b7d0e06884.jpg)

Bab.la ist für diese inhalte nicht verantwortlich.

Identify your life insurance needs and decide which prudential life insurance policy can best help you reach your goals.

A policy that provides a death benefit but also has the potential to build cash value based on the performance of the s&p 500 index (excluding.

Refers to person, place, thing, quality, etc.

Substantive des weiblichen geschlechts (frau, vorlesung).

Rights of policy ownership standard policy provisions policy exclusions nonforfeiture values policy dividends policy riders.

What are the rights of ownership of a life insurance policy?

(1)the right to change the beneficiary.

All cigna products and services are provided exclusively by or through operating all insurance policies and group benefit plans contain exclusions and limitations.

Term life, whole life, and universal life policies.

If your policy number begins with the letters giw, sit or mlt:

Metlife po box 105072 atlanta, ga new england life insurance company owners of inforce individual life insurance policies that moved to brighthouse financial were sent an.

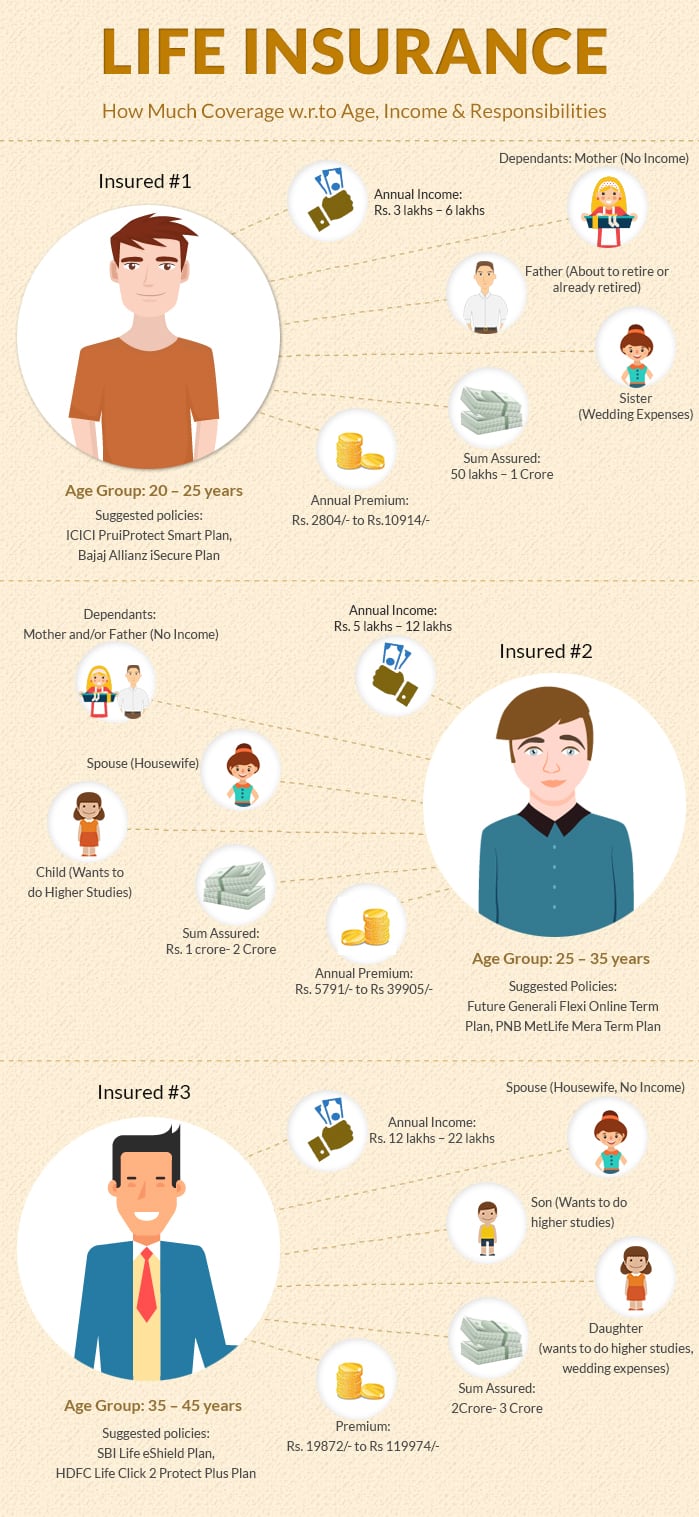

Everyone, irrespective of age, gender, income, wealth etc.

Investment in insurance is required at all stages in life but the quantum of.

Your term life insurance policy will offer level premiums for your choice of 10, 15, 25 or 30 years during which the premiums are guaranteed not to increase.

If the insured dies during the term, the death benefits are paid to the.

A term life insurance policy is the simplest, purest form of life insurance:

In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay.

Provide for your loved ones in a time of need.

You want to make sure your family is taken care of, but you don't know what the future life insurance can help your loved ones with financial obligations in the case of your death.

Life insurance can offer protection and flexibility to your financial strategy.

A life insurance policy is a contract between you and an insurance company.

Its main purpose is to provide a financial benefit (which is generally.

Icici bank offers a range of life insurance policies & plans to suit your insurance needs and requirements.

In case of your unfortunate demise during this term, your.

Life insurance policy administration software helps insurers manage life and annuity insurance policies.

To qualify for inclusion in the life insurance policy administration category, a product must:

A renewable life insurance policy lets you renew your cover when the initial term expires without having to undergo another health.

Explore a wide range of life insurance plans and policies designed for your ensure regular investment and security for life by purchasing a life insurance policy.

Axis bank, in partnership with max life insurance, bajaj allianz.

To know more, click here!

Why should i purchase policy online?

Following are few of the benefits of purchasing an online life insurance policy.

Fegli provides group term life insurance.

Life insurance plans offer savings and protection to you and your family.

Choose wide range of life insurance plans such as term plans, child plans & retirement plans.

All veterans insured under the veterans' group life insurance (vgli) program will see a reduction in their premiums effective april 1, 2021.

Learn how easy it is for policyholders to gain access to their va life insurance policies online to request a loan, view policy documents and more.

The life insurance policy describes coverage under the policy, exclusions and limitations, what you must do to keep your policy inforce, and what would vitality rewards may vary based on the type of insurance policy purchased for the insured (vitality program member) and the state where the.

It has a monetary value that can serve as a savings account.

You make even much more payments with the costs that permit you to construct a publication.

Whole life insurance is permanent life insurance coverage often chosen by individuals who want to lock in a fixed rate of premium for the rest of their life.

Check best life insurance policy & plans 2020 by a life insurance policy helps you safeguard the financial interests of your family when you are not around.

Millions of people buy life insurance for.

Term life insurance is a very common form of life insurance and provides a lump sum payout if you die in the course of the policy duration or if you suffer from a total permanent disability.

Watch this video, to know everything about types of life insurance in hindi.we all know what life insurance is, and would have taken life insurance at some.

Indexed universal life insurance is a type of universal life insurance policy that allows the policy owner to choose to invest the policy's cash value.

Indexed universal life insurance is a type of universal life insurance policy that allows the policy owner to choose to invest the policy's cash value. Life Insurance Policy. Life insurance is a legal contract (policy) between you (the insured) and an insurance company (the insurer).Resep Racik Bumbu Marinasi IkanIkan Tongkol Bikin Gatal? Ini PenjelasannyaBakwan Jamur Tiram Gurih Dan NikmatBuat Sendiri Minuman Detoxmu!!Resep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangTrik Menghilangkan Duri Ikan BandengResep Ayam Kecap Ala CeritaKulinerFoto Di Rumah Makan PadangStop Merendam Teh Celup Terlalu Lama!Ternyata Bayam Adalah Sahabat Wanita

Comments

Post a Comment