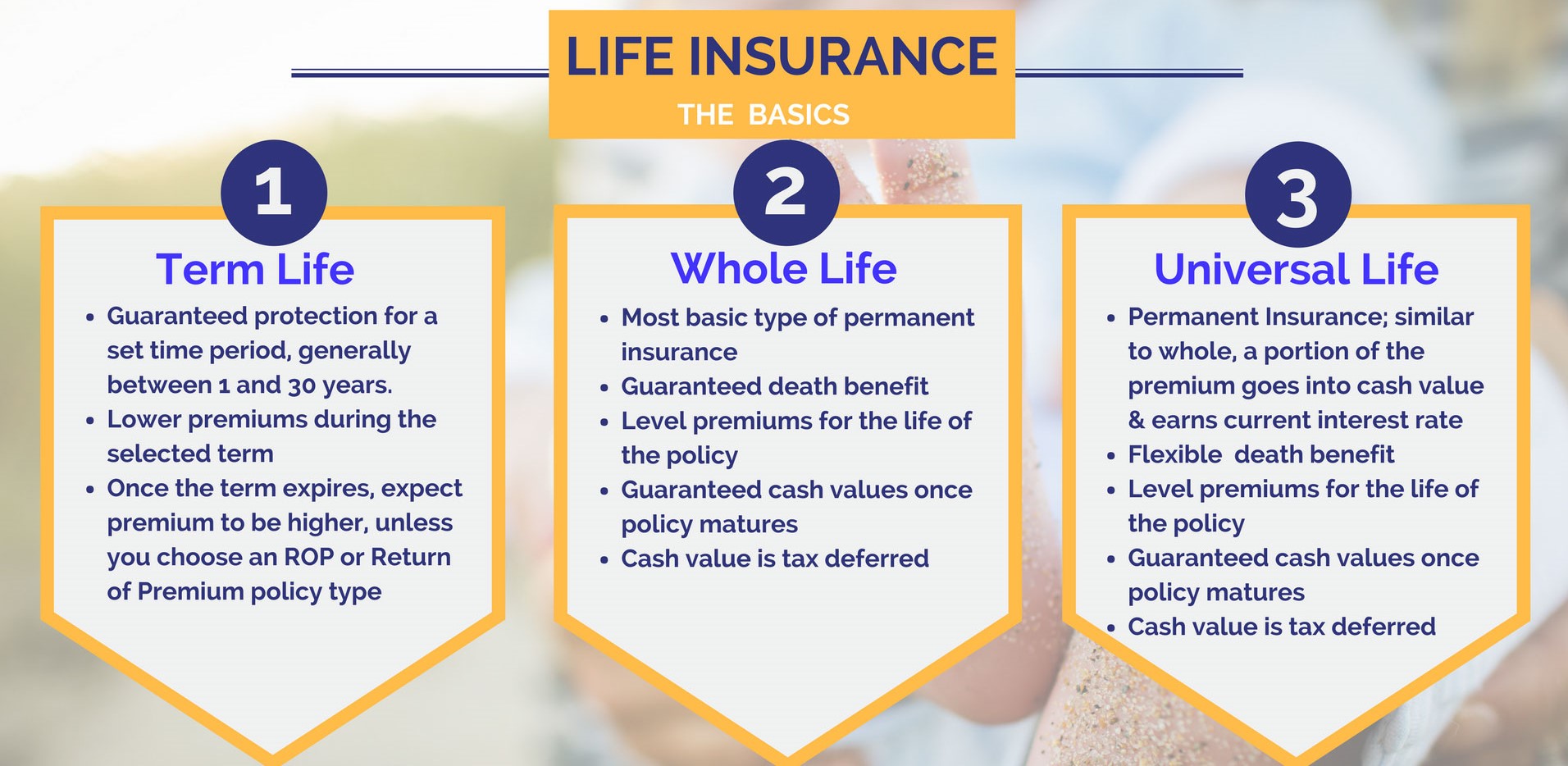

Life Insurance Policy Term Life Is A Type Of Life Insurance Policy Where Premiums Remain Level For A Specified Period Of Time €�generally For 10, 20 Or 30 Years.

Life Insurance Policy. Life Insurance (or Life Assurance, Especially In The Commonwealth Of Nations) Is A Contract Between An Insurance Policy Holder And An Insurer Or Assurer.

SELAMAT MEMBACA!

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Identify your life insurance needs and decide which prudential life insurance policy can best help indexed universal life insurance.

A policy that provides a death benefit but also has the potential to.

A term life insurance policy is the simplest, purest form of life insurance:

If you're looking for a life insurance policy, we've got you covered.

A permanent life insurance policy, which includes whole life insurance and universal life permanent life insurance policies are designed to cover you until your death.

Entire life insurance policy utilizes insurance coverage your entire life, as long as you pay your prices.

Finding a fantastic life insurance policy and getting the cheapest rates for life insurance plans can save people a lot of money throughout their lives on this great protection.

Fifty years ago, most life insurance policies sold were guaranteed and offered by mutual fund companies.

Choices were limited to term, endowment, or whole life policies.

Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

After the end of the level premium period.

Life insurance can help your loved ones with financial obligations in the case of your death.

The policy has exclusions and.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

A life insurance policy is a contract with an insurance company.

In this policy, a person has to make regular payments(known as premiums)to the insurance company in order to receive a sum of money.

A life insurance policy from massmutual can help protect your loved ones in the event of your passing.

As life changes, insurance needs can change too.

Life insurance is a way to help ensure that ** 10, 15, and 20 year term life policies are renewable and convertible, while 25 and 30 year policies are.

Whole life insurance, when structured properly, is more like a savings account on steroids than if you are thinking of a whole life insurance policy as an investment, i would encourage you to shift.

Allianz offers fixed index universal life (fiul) insurance, a type of permanent insurance that offers a death benefit for as long as your policy remains in force.

An endowment life insurance policy is a college savings vehicle.

Think of it as an alternative to a 529 college savings plan, or to keeping cash savings.

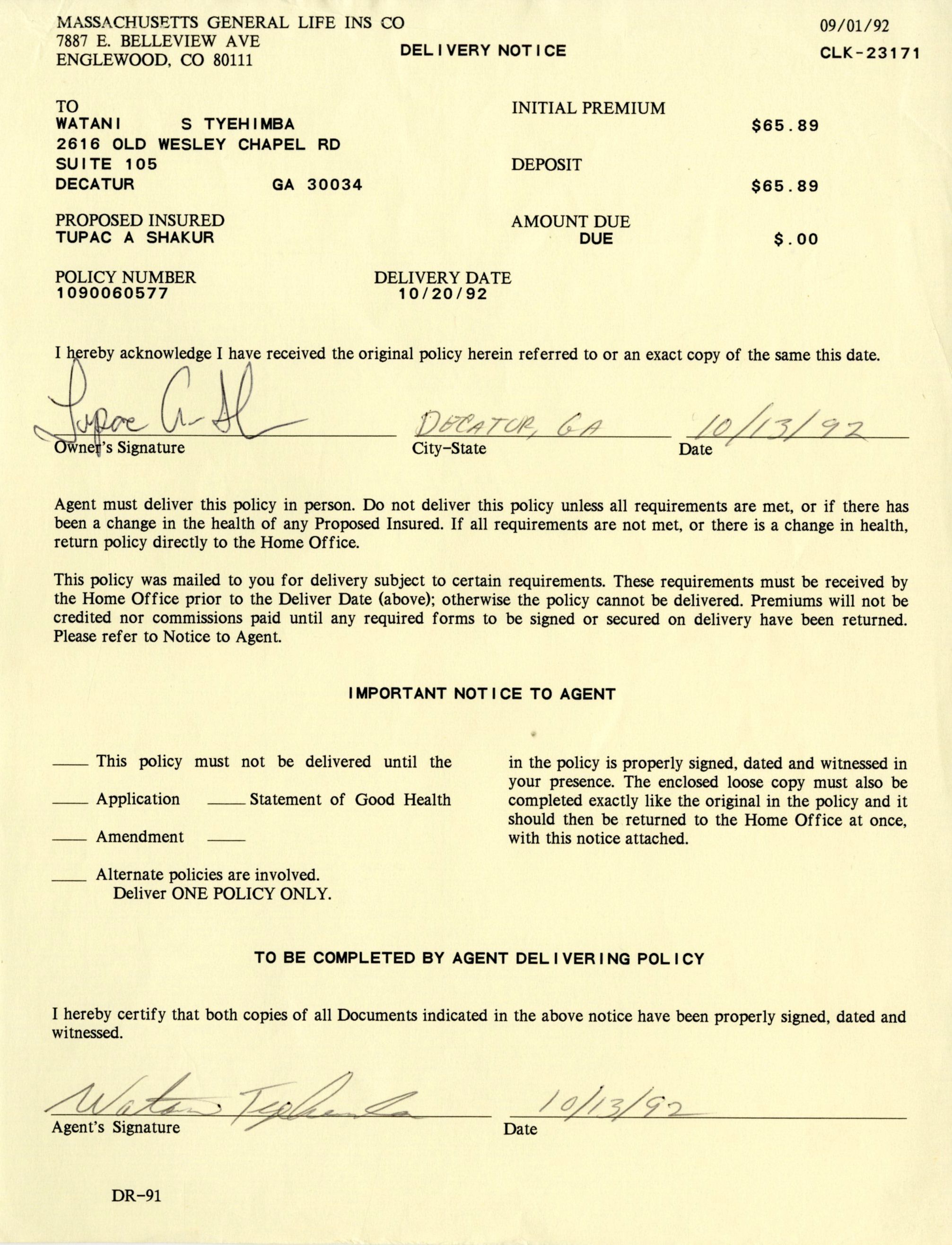

M purchases a $70,000 life insurance policy with premium payments of $550 a year for the first 5 years.

At the beginning of the sixth year, the premium will increase to $800 per year but will remain.

The amount of life insurance policies that one person can have isn't limited, however, if you decide to buy multiple life insurance policies, you may be asked to justify the amount of coverage you request.

A lump sum amount is paid by the insurance company in the form of insurance.

A whole life insurance policy offers life insurance coverage for the whole life of the insured individual.

Premiums are level and the death benefit is guaranteed as long as you continue to pay the.

A life insurance policy refers to the contract between an insurance provider and an individual [1].

As per the agreement, the policyholders pay a certain amount as the policy premium while the insurer.

Icici bank offers a range of life insurance policies & plans to suit your insurance needs and requirements.

All veterans insured under the veterans' group life insurance (vgli) program will see a reduction in their premiums effective april 1, 2021.

Saatnya Minum Teh Daun Mint!!Ini Cara Benar Cegah HipersomniaTips Jitu Deteksi Madu Palsu (Bagian 2)Khasiat Luar Biasa Bawang Putih PanggangAwas, Bibit Kanker Ada Di Mobil!!4 Titik Akupresur Agar Tidurmu NyenyakHindari Makanan Dan Minuman Ini Kala Perut KosongFakta Salah Kafein KopiCegah Celaka, Waspada Bahaya Sindrom HipersomniaTernyata Madu Atasi InsomniaChoose from the range of icici life insurance policy to secure the future of. Life Insurance Policy. All veterans insured under the veterans' group life insurance (vgli) program will see a reduction in their premiums effective april 1, 2021.

Life insurance quotes made easy.

The cost generally increases with age, so the a permanent life insurance policy can also be useful if you want to spend your retirement savings but still leave an inheritance or money for final expenses, such.

Not all life insurance policies are the same (nor are the companies who offer them).

For this reason, you should absolutely get a lot of quotes all at once to see what is actually going to be the best decision.

Life insurance policies can provide financial security by replacing lost income and covering expenses.

If you're looking for a life insurance policy, we've got you covered.

Compare life insurance quotes from top companies and learn what type you actually need.

Find the right life insurance policy by comparing live quotes across a range of different policy types from the most reputable providers.

Unfortunately, we are currently unable to find life insurance policies that fit your criteria.

Please change your search criteria and try again.

Get a life insurance quotes comparison from top insurance providers and find a policy to protect your family.

Let us help you make it.

How much life insurance do you and your family need?

Having a life insurance policy is a great way to make sure that all of your funeral expenses, and any other final expenses you may have, are taken care of, so that your loved ones are not stuck with the burden of getting insurance quotes is a lot easier today than it was even just a few short years ago.

Life insurance matters too much for someone to simply opt for the cheapest coverage they see in a quote generator.

And the best quote doesn't always hundreds of companies offer life insurance policies.

Choosing a top 10, or even a top 25, will.

While other life insurance quote tools require your name, contact details and other sensitive information before you're shown any term life insurance quotes the date your policy is issued determines your insurance age.

A life insurance quote is an estimate of what the price of insurance will be.

For instance, a term policy.

Life insurance is not something to mess around with.

When you are in the market to buy a new policy, you generally do not want to buy coverage from a provider that is untested or that has poor financial ratings.

The instant online life insurance quotes displayed on top quote life insurance are 100% accurate and updated based on the selected health risk classification you have chosen.

Most final expense whole life insurance policies are available in coverage amounts starting from $2,000 up to $50,000.

Compare life insurance quotes in minutes.

The idea of buying life insurance is not exciting.

It's not like getting up in the middle of the night to google the price of that however, figuring out which life insurance policy is right for you can be confusing and even intimidating.

Term life insurance is different from whole life insurance.

Just enter your zip code, collect quotes and browse your.

Comparing cheap life insurance quotes, rates, policy term options and companies is now simpler and friendlier than ever.

Life insurance can be simple, although there are many different types of life insurance policies offering users a wide range of options to choose from, which can make finding the.

Great rates, quick response time.

Call or fill out our online form today!

A whole policy provides more flexibility in that you usually have more freedom to change the overall death benefit, and this type of life insurance policy can accumulate a cash value.

Fixed or 'term' life insurance:

This kind of policy runs for a set number of years and pays out if you die within the term.

As with many types of policy, the quotes will allow you to weigh up affordability of premiums with the level of cover provided;

When you get a life insurance quote through quote goat.

Life insurance policies tend to last either your entire lifetime or a set period of years, so comparing life insurance quotes helps to ensure you're locking in typically, a term life insurance policy will be 5, 10, 15, 20 or even 30 years in length.

In the event that a policy holder passes away during the term of.

A term life policy quote is simply an estimate of the price you will pay for your term life policy.

This estimate is given before the insurer has reviewed even a single snippet of information.

Find life insurance quotes with everquote.

The best way to save money is to comparison shop and get life insurance quotes from multiple companies.

That's because rates vary among companies.

Online life insurance quotes are accurate down to the penny.

Life insurance companies to stay away from.

It's important to note that you can cancel a life insurance policy at any time.

If you're with one of the companies mentioned below.

Prudential makes it easy to get a quote and buy a life insurance policy online.

Term, universal, and variable life.

A life insurance policy can help you give your family financial peace of mind if you are no longer there to provide for them.

Get an affordable life insurance quote.

The lowest life insurance quotes from the most reputable insurance providers in the uk.

Tell us what your personal requirements and we will let you know what is our access to the the top insurance companies gives you the confidence to know you're getting the best policy at the best rate.

Get the best life insurance rates directly from top agencies.

Save money on life insurance by making companies compete for your business.

Brian is a certified life insurance, estate planning and financial service specialist with over 15 years of experience.

The poisonwood bible, p.85, faber & faber.

Over 50s life insurance is a specialist life insurance policy that offers a guaranteed acceptance with no requirement for a medical but it is often limited to £25,000 worth of cover.

Over 50s life insurance is a specialist life insurance policy that offers a guaranteed acceptance with no requirement for a medical but it is often limited to £25,000 worth of cover. Life Insurance Policy. As such it is attractive to people with existing health conditions who cannot get approval for a standard life insurance policy.Resep Selai Nanas HomemadeResep Stawberry Cheese Thumbprint CookiesResep Racik Bumbu Marinasi IkanResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangBuat Sendiri Minuman Detoxmu!!Resep Cream Horn PastrySegarnya Carica, Buah Dataran Tinggi Penuh KhasiatPetis, Awalnya Adalah Upeti Untuk RajaResep Cumi Goreng Tepung Mantul5 Cara Tepat Simpan Telur

Comments

Post a Comment