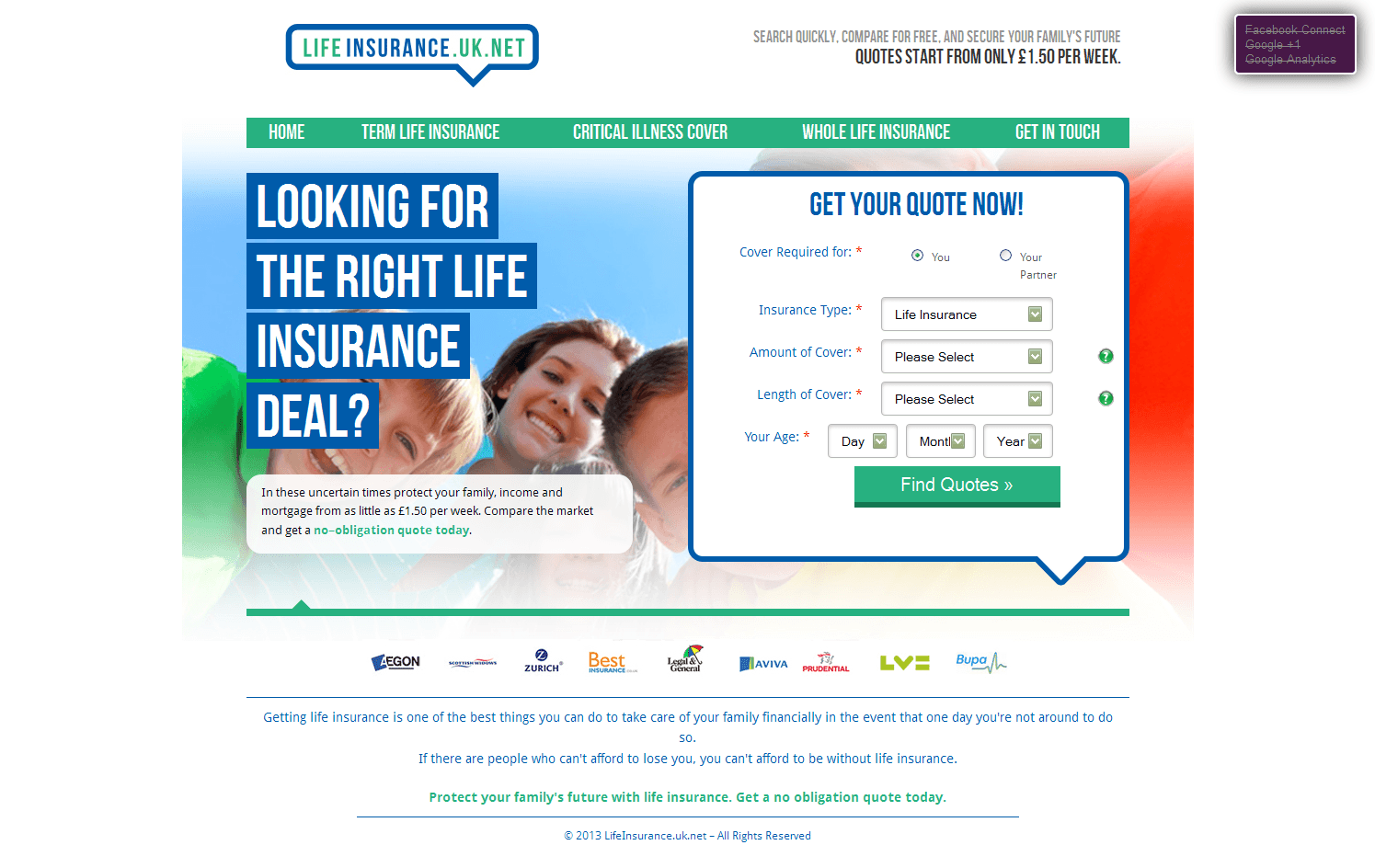

Life Insurance Uk Compare The Leading Uk Life Insurance Providers & Save.

Life Insurance Uk. Life Insurances Uk Is The Trading Name Of Ims Independent Mortgage Solutions Limited (no.

SELAMAT MEMBACA!

Hsbc life cover is provided by hsbc life (uk) limited.

Get an affordable life insurance policy.

Joint life insurance for partners.

Those in a relationship are able to take out a joint policy that will pay.

Life insurances uk is the trading name of ims independent mortgage solutions limited (no.

6745929), regulated by the fca (no.

Life insurance uk life insurance.

Life insurance can help you plan for the future and keep your loved ones financially secure.

Compare these companies to find the right level of cover for the people you care about the most.

Best health insurance uk best life insurance companies private medical treatment costs health insurance renewal switch health insurance save money on life insurance life insurance broker.

Critical illness and income protection are also.

Protect your loved ones with life insurance, mortgage protection insurance & lifestyle insurances through nationwide.

You may be surprised by our findings.

Read our 2021 guide on protecting your loved ones, speak to our expert advisers and compare instant quotes online from aviva, vitality and other top uk insurers.

A life insurance is predominantly for your family & loved ones so the question is do we really need a life best life insurance cover uk | life insurance brokers, affordable life insurance quotes uk.

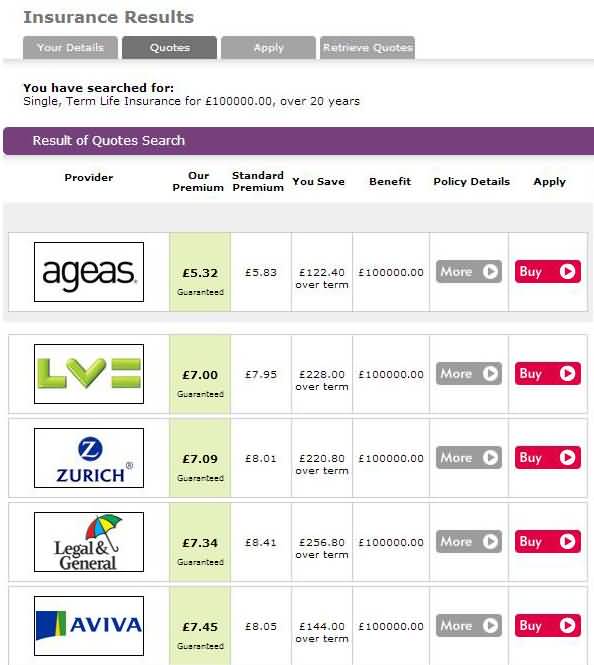

We compare the insurance market and find the very best deals for you and your circumstances.

Protect your family with life insurance today to have that peace of mind you have been after.

Helps you to find life insurance offers and reviews quickly and easily.

Level term life insurance can also pay out if you're diagnosed with a terminal illness.

To find the best life insurance, uk wide, when you compare life insurance quotes think about three things.

Find out more at santander.co.uk.

Get an online life insurance quote with lloyds bank life insurance.

Here at uk life insurance solutions our company mission is quite simple.

We aim to provide the most competitive online uk life insurance quotes for all our visitors.

Our staff are trained to a very high.

It's quick and easy to set up.

It doesn't need to be post office money life insurance offers up to £500,000 cover for customers who are uk residents.

Getting quality life insurance in the uk can be critical to you or your family especially if you are when comparing life insurance policies in the uk, it can be considerably difficult finding a policy that.

We're not tweeting from this account at present.

Life insurance is a contract between an individual(s) and an insurance company where in the event we have sourced one of the best independent life insurance specialists in the uk (with almost 15.

Choose your uk life insurance with smart insurance.

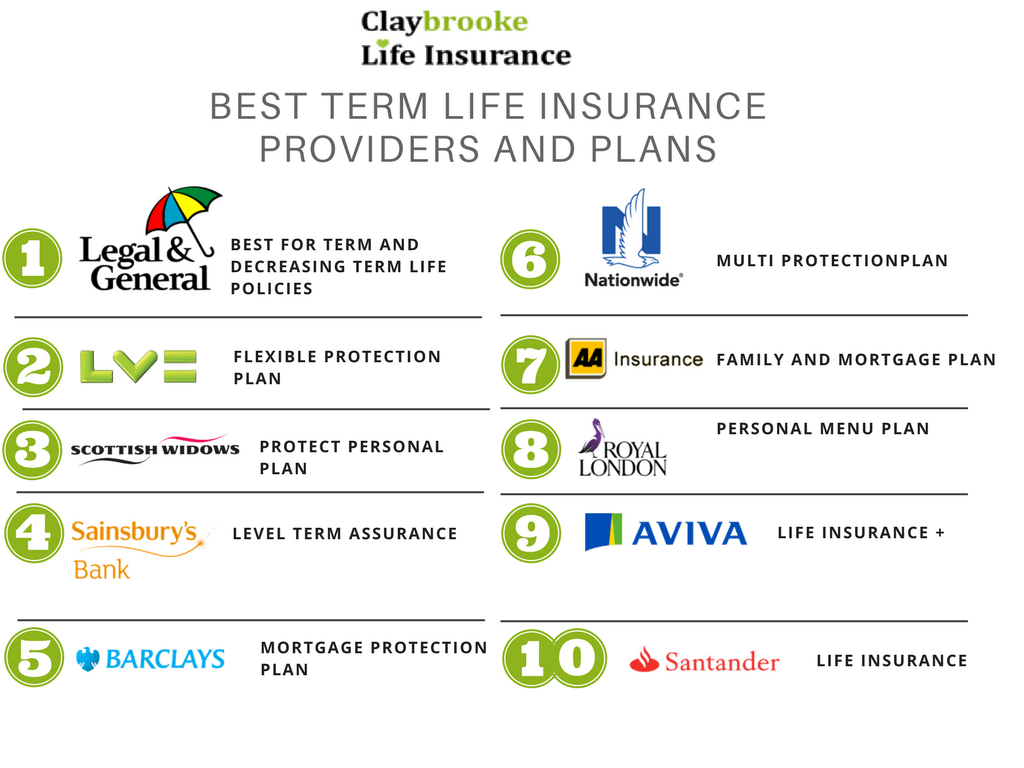

![Top 10 Best Life Insurance Companies Reviews For 2019 [QUOTES]](https://www.claybrooke.org.uk/wp-content/uploads/2019/03/whole-of-life-providers-img-1024x768.png)

Get peace of mind and help secure your family's financial future after you're gone.

Compare the leading uk life insurance providers & save.

A typical life insurance policy will pay your dependants a set amount of money as a lump sum if you pass away within a specified period.

![UK Life Insurance Coverage [2020 Research] | Reassured](https://assets.reassured.co.uk/infographics/life-insurance-uk-premiums-mobile.jpg?mtime=20200506122124&focal=none)

Find the right life insurance policy to cover you and the ones you love when you compare quotes with moneysupermarket.

Is the uk prepared for the worst?

Ternyata Tidur Bisa Buat MeninggalManfaat Kunyah Makanan 33 KaliSaatnya Bersih-Bersih UsusCegah Celaka, Waspada Bahaya Sindrom HipersomniaAwas!! Ini Bahaya Pewarna Kimia Pada MakananTernyata Tahan Kentut Bikin Keracunan8 Bahan Alami Detox Ini Efek Buruk Overdosis Minum KopiPD Hancur Gegara Bau Badan, Ini Solusinya!!Segala Penyakit, Rebusan Ciplukan ObatnyaFind the right life insurance policy to cover you and the ones you love when you compare quotes with moneysupermarket. Life Insurance Uk. Is the uk prepared for the worst?

The average cost of life insurance in the uk varies from £30.40[1] to £15.85[2] depending on which research you refer to.

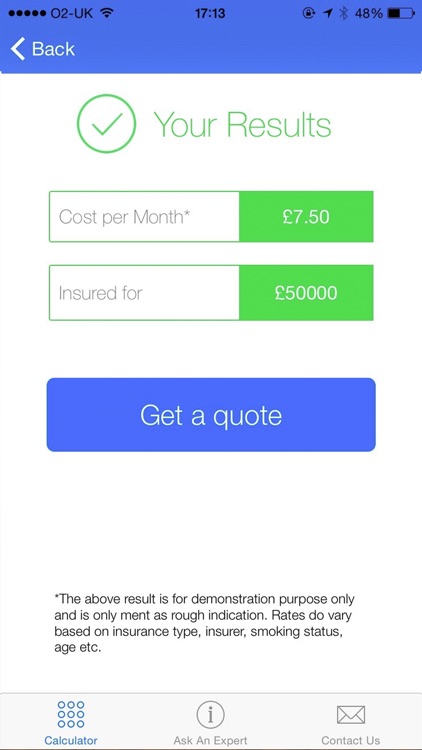

Our life insurance cost calculator can help you estimate how much a term life policy could cost, based on national averages.

Your age can also significantly affect premium costs.

The older you are, the more likely you are to die soon, which means life insurers view you as a bigger risk.

What's the average life insurance cost per month for a smoker?

The average life insurance cost depends on many unique factors that depend on your lifestyle, age, occupation and overall health, however you have a in the latter case, the insurer will then work out an average life insurance cost spread over monthly premiums.

Since it's difficult to determine an.

The cost of life insurance depends on a host of factors, but to give you an idea on how much you might pay per month for life insurance cover, we have carried out research on a number of policies.

Class 1 national insurance (ni) contribution rates for tax year 2020 to 2021, what ni category letters mean.

We'd like to set additional cookies to understand how you use gov.uk, remember your settings and improve government services.

What is the average life insurance payout?

Is free life cover available?

How do interest rates affect what impacts the cost a life insurance policy?

Want to know how the average cost of life insurance changes based upon your policy, age and health?

Life insurance helps give your family financial protection should you pass away within the policy term.

With annual health checks, mental.

Certainly, health will also play a key role in the premiums that are charged for a policy.

We can easily help you find your average cost of life insurance.

Talk to an insurance geek today!

According to sunlife's annual cost of dying report, in 2020 the cost of an average funeral stands at £4,417.

Our life insurance cost calculator lets you compare life insurance quotes from every major uk provider.

Insurers we offer quotes from include

Read more to find out how much home insurance in the uk, home buildings and contents insurance costs around £29 a month, which costs around 9% more than if you pay upfront.

Average cost of life insurance.

Read on to see what you can expect to pay for life insurance.

Latest data shows the average price of.

Uk life insurance companies will want to know your complete medical history and current state of health to estimate when the policy may be paid out and how much to charge in premiums before this happens.

If you have health conditions that could mean you pass away earlier than average.

How much do people pay for life insurance?

Other factors that can influence life insurance rates.

Life insurance is surprisingly affordable, but the cost varies based on the specific type of life insurance.

Use our life insurance calculator to work out how much life insurance you will need, as well as the costs involved in taking out a policy.

Our life insurance calculator considers the important things in your life you should provide cover for, such as paying off your mortgage and providing for your family.

9 best whole of life insurance policies in the uk.

What's the average cost of life insurance.

Life insurance quotes will vary drastically according to the amount of cover you want, so when you compare different life insurance companies, it's essential.

Expect whole life premiums to cost between $250 to $1,000 a month if you're young and healthy, and that price increases significantly as you age.

The average cost of a contents insurance policy is £59.22 per year, yet those 7.5 million with no policy in place are leaving over £266 billion in possessions figures from the abi show that the total value of possessions owned by all uk households comes in at a whopping £950 billion.

Average homeowners insurance cost by company.

Components of homeowners insurance policies.

It depends, but the national average for home insurance is $1,312 per year for $250,000 in dwelling coverage.

Hsbc life insurance offers you peace of mind, knowing your loved ones are financially protected if the unexpected happens.

Find out more on this page about what life cover, critical illness cover and income cover is underwritten by hsbc life (uk) ltd.

The cost of life insurance is largely dependent on your personal circumstances, including your age, health condition and lifestyle.

Many top insurance providers claim to quote as low as £6 a month, but the average cost of premiums currently is approximately £29.72.

The average cost in the uk in 2018 was £163 per year.

As in many other countries, life insurance in the uk is not compulsory but many individuals take out a policy to provide for their family and dependents in the.

Compare and buy life insurance term life insurance whole life insurance permanent life key takeaways.

The average homeowners' insurance cost varies by state, but that's according to insurance.com's analysis of average cost of home insurance for nearly every zip code in the country.

Read this comprehensive article that compares whole life insurance rates by age and other factors from top companies.

Different types of life insurance have different costs.

You should know the type of insurance you pick, which will greatly impact your rates.

Average life insurance rates by age, gender, & policy length (in 2021).

Average life insurance rates by age and gender.

The amount you pay each year for your term or whole life insurance depends on several factors.

Your monthly premium will also depend.

United states japan china united kingdom france ireland eu average.

Rising repair costs, repeated hikes in insurance premium tax, and with the industry anticipating significantly higher bodily injury.

Average cost of term vs.

Life insurance cost depends largely on your age.

Average cost of term vs. Life Insurance Uk. Life insurance cost depends largely on your age.Sensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangWaspada, Ini 5 Beda Daging Babi Dan Sapi!!5 Cara Tepat Simpan TelurResep Selai Nanas HomemadeSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatResep Beef Teriyaki Ala CeritaKulinerTips Memilih Beras BerkualitasKhao Neeo, Ketan Mangga Ala ThailandTernyata Kue Apem Bukan Kue Asli Indonesia

Comments

Post a Comment