Life Insurance Policy An Endowment Life Insurance Policy Is A College Savings Vehicle.

Life Insurance Policy. You've Had Term Life Insurance For The Past 10 Or 20 Years.

SELAMAT MEMBACA!

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

A term life policy is exactly what the name implies:

Coverage for a specific term or length of time, typically between 10 and 30 years.

It is sometimes called pure life insurance because.

If you're looking for a life insurance policy, we've got you covered.

Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

After the end of the level premium period.

Here's what you need to know.

Life insurance policies help provide security to either you or your beneficiaries after you pass away or after a designated period of time.

With a life insurance policy from nationwide.

Fifty years ago, most life insurance policies sold were guaranteed and offered by mutual fund companies.

Choices were limited to term, endowment, or whole life policies.

Beneficiaries of an individual life insurance policy (not purchased through an employer) can visit if your employer offers life insurance, find out what options may be available to you.

The policy or its provisions may vary or be unavailable in some states.

The policy has exclusions and.

Entire life insurance policy utilizes insurance coverage your entire life, as long as you pay your a life insurance policy plan is a plan with an insurance company.

Think of it as an alternative to a 529 college savings plan, or to keeping cash savings.

Video overview of the fegli life insurance program for annuitants and retiring employees.

Fegli provides group term life insurance.

Learn about the different types of life insurance coverage to help you narrow your policy options.

How long do i need cover?

Life insurance coverage to last a lifetime.

Family servicemembers' group life insurance (fsgli) insures spouses and children of servicemembers with sgli coverage.

Spousal coverage may not exceed the servicemember's.

However, the benefits are distributed proportionally over a period, and not in one go at the end of policy term.

Premiums are level and the death benefit is guaranteed as long as you continue to pay the.

You've had term life insurance for the past 10 or 20 years.

It's been an inexpensive way to have peace of mind, but the policy is coming to an end.

A life insurance policy refers to the contract between an insurance provider and an individual [1].

As per the agreement, the policyholders pay a certain amount as the policy premium while the insurer.

Choose from a range of life insurance plans from hdfc life that best suits your.

All permanent life insurance policies have three puzzle pieces that must fit together anyone who has a need for a permanent life insurance policy should consider a universal life policy.

With the vast number of insurance options available today, choosing which policies will work best for your goals can be challenging.

M purchases a $70,000 life insurance policy with premium payments of $550 a year for the first 5 years.

Explore a wide range of life insurance plans and policies designed for your unique needs.

Ternyata Orgasmes Adalah Obat Segala Obat3 X Seminggu Makan Ikan, Penyakit Kronis MinggatCegah Celaka, Waspada Bahaya Sindrom HipersomniaIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatAwas!! Ini Bahaya Pewarna Kimia Pada MakananTernyata Jangan Sering Mandikan BayiWajah Mulus Dengan Belimbing WuluhTernyata Inilah Buah Yang Bagus Untuk Menahan LaparTernyata Salah Merebus Rempah Pakai Air Mendidih5 Tips Mudah Mengurangi Gula Dalam Konsumsi Sehari-HariAt the beginning of the sixth year, the premium will increase to $800 per year but will remain. Life Insurance Policy. Explore a wide range of life insurance plans and policies designed for your unique needs.

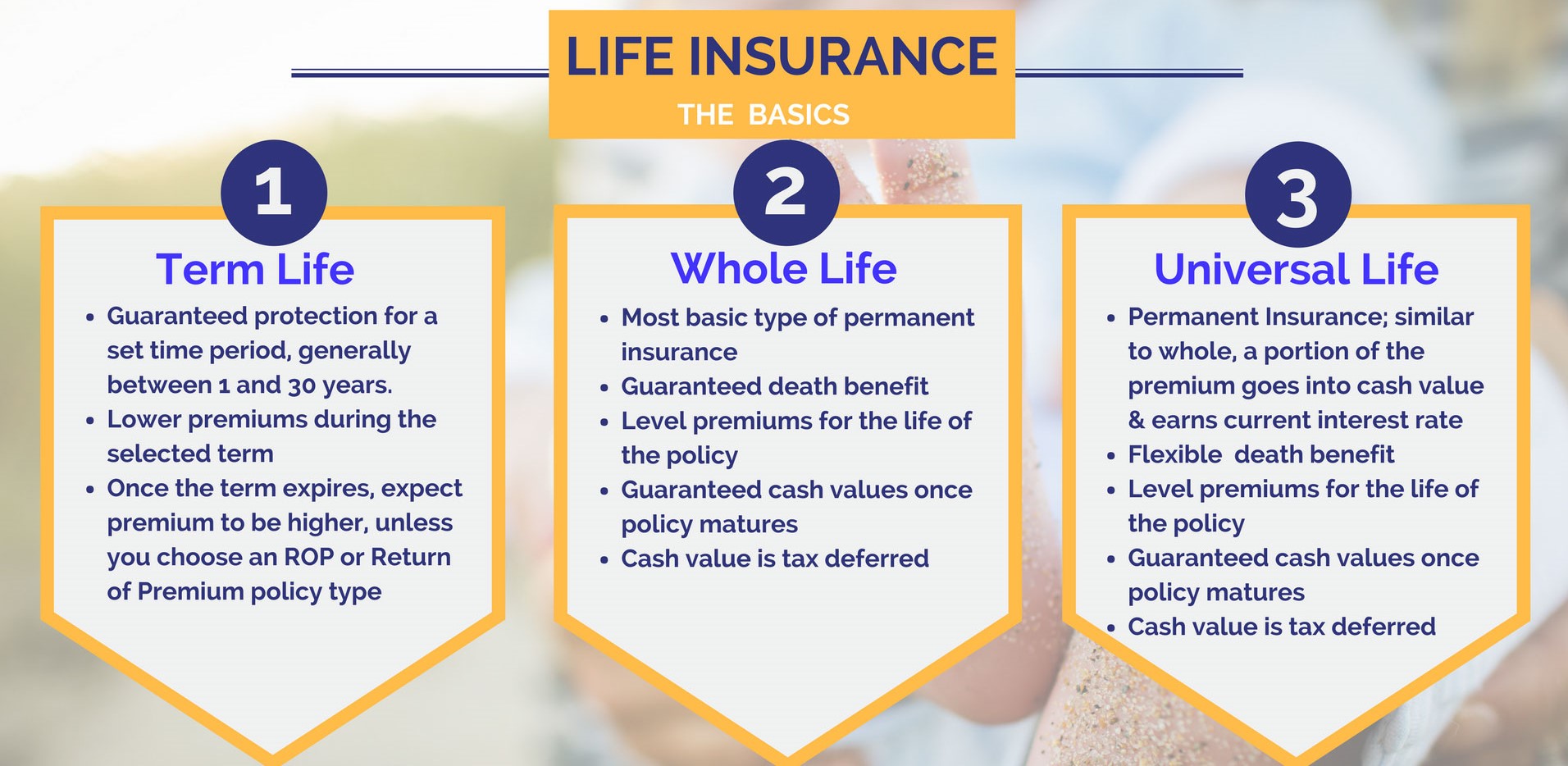

Understanding the types of life insurance policies doesn't have to be complicated.

A permanent policy lasts for the life of the insured, for whole life as long as premiums are paid, and for universal life as long as the policy.

The two primary types of life insurance—term life and permanent life—are just the tip of the iceberg.

Insurance companies also offer dozens of other insurance think of joint life insurance policies as the joint checking account of the life insurance world.

What type of life insurance is best for you?

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an investment vehicle.

These life insurance types are whole life insurance, term life insurance, universal life insurance, and variable universal life insurance.

Understanding the different types of life policies.

Answering those questions can help you understand which type of life insurance would work for your situation.

Convertible life insurance policies allow you to start off with a term life insurance policy and convert it to a whole life policy.

Costs can be as low as a few dollars a month or as high as several hundred.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Variable universal life insurance is similar to regular universal life insurance coverage, except in this case, the policyholder is allowed to invest the cash in their policy into different types of investments such as mutual funds.

Also, there will be no guaranteed minimum cash value in this type of policy.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Before you shop, let protective life help you understand the features and benefits of a policy.

10 types of life insurance:

Which flavor is right for you?

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family).

Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations.

A life insurance policy guarantees the insurer pays a sum of money to named beneficiaries when the insured policyholder dies, in exchange for the term life insurance policies expire after a certain number of years.

3whole life advantage® is a whole life insurance policy issued by allstate assurance company, 3075 sanders rd., northbrook il 60062 and is available in most states with contract series icc18ac1/nc18ac1 and rider series.

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company.

There are various companies offering different types of life insurance policies.

So, if you call up a typical agency you are only going to be able to get quotes on a few different policy types, primarily term, final expense.

The most common type of permanent life insurance is whole life insurance.

At that time, you could take.

What life insurance policy type is best for me?

Types of life insurance policies.

Simplified issue life insurance is most commonly a type of term life insurance that allows you to get approved for life insurance extremely fast.

Life insurance comes in many flavors, and permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

The great recession has taught a big lesson to many americans about the importance of financial planning.

As the economy expands and more jobs are created, people have started focusing on their savings plans, retirement plans, and life insurance (iak) (kie).

The most common are term, whole life and universal life insurance.

Universal life insurance is a flexible product.

The policy owner can modify a monthly premium when needed or increase or decrease the death benefit to accommodate life events.

Permanent life insurance can be mainly classified into two basic categories:

Universal life and whole life.

Plus, there are several variations of both universal and whole life that we will discuss in greater detail.

Dind out everything you need to know about life insurance policy types and features.

What are the different policy types when taking out life insurance?

What is the difference between single and joint life policy type?

With the life insurance types explained, you can decide which type of life insurance is best for your needs.

This post will help you make sense of the index universal life policy differs from other types of permanent policies in that its cash value growth is based around the equity index performance.

The two primary types of life insurance policies are term life insurance and permanent life insurance.

However, if you die after the end of your policy's term, your beneficiaries won't receive death benefits.

A variety of term plans are offered by life universal life policy.

This policy is not only sensitive to interest rates but also quickly reflects changes in the insurance company's expenses and mortality.

With this kind of policy, you enter a contract that will pay out a defined death benefit as long as you pay a set premium to keep the policy in force.

As you pay your premiums, the cash value of your policy grows.

With this kind of policy, you enter a contract that will pay out a defined death benefit as long as you pay a set premium to keep the policy in force. Life Insurance Policy. As you pay your premiums, the cash value of your policy grows.Trik Menghilangkan Duri Ikan BandengNikmat Kulit Ayam, Bikin SengsaraIkan Tongkol Bikin Gatal? Ini PenjelasannyaIni Beda Asinan Betawi & Asinan BogorTernyata Makanan Ini Berasal Dari Dewa BumiFakta Perbedaan Rasa Daging Kambing Dan Domba Dan Cara Pengolahan Yang BenarTernyata Makanan Ini Hasil NaturalisasiTernyata Hujan-Hujan Paling Enak Minum RotiResep Yakitori, Sate Ayam Ala JepangResep Pancake Homemade Sangat Mudah Dan Ekonomis

Comments

Post a Comment