Life Insurance Policy A Person Shopping For Life Insurance Has Many Things To Consider Before Making A.

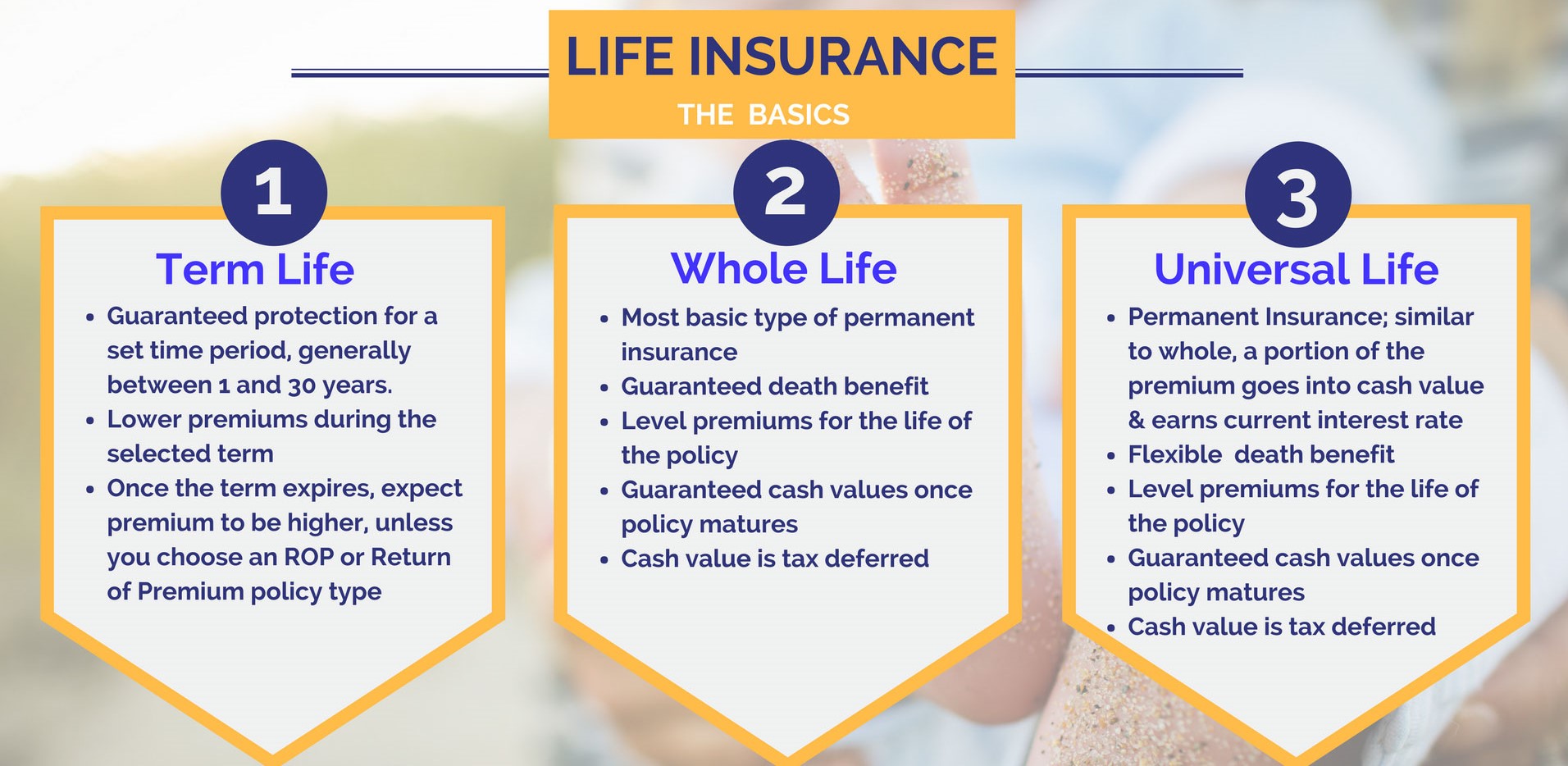

Life Insurance Policy. Term Life Is A Type Of Life Insurance Policy Where Premiums Remain Level For A Specified Period Of Time €�generally For 10, 20 Or 30 Years.

SELAMAT MEMBACA!

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

A policy that provides a death benefit but also has the potential to.

A life insurance policy can help you give your family financial peace of mind if you are no longer there to provide for them.

Life insurance policies can provide financial security by replacing lost income and covering expenses.

A term life insurance policy is the simplest, purest form of life insurance:

A permanent life insurance policy, which includes whole life insurance and universal life permanent life insurance policies are designed to cover you until your death.

Life insurance policies help provide security to either you or your beneficiaries after you pass away or after a designated period of time.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Finding a fantastic life insurance policy and getting the cheapest rates for life insurance plans can save people a lot of money throughout their lives on this great protection.

Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

After the end of the level premium period.

Life insurance can help your loved ones with financial obligations in the case of your death.

The policy has exclusions and.

How long do i need cover?

Beneficiaries of an individual life insurance policy (not purchased through an employer) can visit if your employer offers life insurance, find out what options may be available to you.

A person shopping for life insurance has many things to consider before making a.

However, the benefits are distributed proportionally over a period, and not in one go at the end of policy term.

Choose the type of life insurance policy that meets your coverage goals and current family budget.

Life insurance coverage to last a lifetime.

Allianz offers fixed index universal life (fiul) insurance, a type of permanent insurance that offers a death benefit for as long as your policy remains in force.

Choose from a range of life insurance plans from hdfc life that best suits your.

Guaranteed issue policies however, limit the amount of insurance often to $50,000 or possibly $100.

A whole life insurance policy offers life insurance coverage for the whole life of the insured individual.

Premiums are level and the death benefit is guaranteed as long as you continue to pay the.

As per the agreement, the policyholders pay a certain amount as the policy premium while the insurer.

Whole life insurance, when structured properly, is more like a savings account on steroids than if you are thinking of a whole life insurance policy as an investment, i would encourage you to shift.

Understand & buy various life insurance plans online in india.

Term life policies are the only type of insurance that allows policy loans.

A loan can be taken out for up to the face amount of the policy.

Net death benefit will be reduced if the loan is not repaid.

Life insurance is a way to help ensure that ** 10, 15, and 20 year term life policies are renewable and convertible, while 25 and 30 year policies are.

Life insurance is a financial product, wherein the policy holder and the life insurance company comes to an agreement.

A lump sum amount is paid by the insurance company in the form of insurance.

Think of it as an alternative to a 529 college savings plan, or to keeping cash savings.

How does life insurance work?

Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatPentingnya Makan Setelah OlahragaTernyata Menikmati Alam Bebas Ada ManfaatnyaIni Cara Benar Cegah HipersomniaMulti Guna Air Kelapa HijauMulai Sekarang, Minum Kopi Tanpa Gula!!Ini Manfaat Seledri Bagi Kesehatan8 Bahan Alami Detox Ternyata Ini Beda Basil Dan Kemangi!!Ternyata Madu Atasi InsomniaHow does life insurance work? Life Insurance Policy. The way life insurance works is that you (the insured) will make monthly payments (your premium) to an insurance company, and if you die while the policy is still.

Understanding the types of life insurance policies doesn't have to be complicated.

A permanent policy lasts for the life of the insured, for whole life as long as premiums are paid, and for universal life as long as the policy.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Understanding the different types of life policies.

Answering those questions can help you understand which type of life insurance would work for your situation.

Variable universal life insurance is similar to regular universal life insurance coverage, except in this case, the policyholder is allowed to invest the cash in their policy into different types of investments such as mutual funds.

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

This guide will help you understand each.

Term life insurance is by far the least expensive type of life insurance policy to pay on a yearly basis.

Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy.

That's because it's insurance that does one thing and one think of joint life insurance policies as the joint checking account of the life insurance world.

The policy covers two individuals for one fee.

Permanent life insurance policies remain active until the insured dies, stops.

3whole life advantage® is a whole life insurance policy issued by allstate assurance company, 3075 sanders rd., northbrook il 60062 and is available in most states with contract series icc18ac1/nc18ac1 and rider series.

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium goes toward building cash value from investments made by the insurance company.

Before you shop, let protective life help you understand the features and benefits of a policy.

10 types of life insurance:

Which flavor is right for you?

Whole of life, term life, decreasing insurance:

Dind out everything you need to know about life insurance policy types and features.

What are the different policy types when taking out life insurance?

There are various companies offering different types of life insurance policies.

Some companies don't offer all types of coverage.

So, if you call up a typical agency you are only going to be able to get quotes on a few different policy types, primarily term, final expense.

Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations.

Therefore, learning about the different types of life insurance policies and coverages is critical.

Life insurance comes in many flavors, and permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

The most common are term, whole life and universal life insurance.

Universal life insurance is a flexible product.

The policy owner can modify a monthly premium when needed or increase or decrease the death benefit to accommodate life events.

This type of insurance is known as renewable term life insurance.

This refers to policies that allow the plan holder to renew their deal when the agreed term runs out.

This type of life insurance policy pays out its sum in the form of an income, instead of as one lump payment.

Types of life insurance policies.

Simplified issue life insurance is most commonly a type of term life insurance that allows you to get approved for life insurance extremely fast.

There are five different types of life insurance policies available, and here are their features and benefits:

You pay a premium to an insurance company for a specific number of years and in.

The great recession has taught a big lesson to many americans about the importance of financial planning.

As the economy expands and more jobs are created, people have started focusing on their savings plans, retirement plans, and life insurance (iak) (kie).

What are the differences between term life & permanent life?

A whole life insurance policy extends till the lifespan of the insured person, unlike other types of life insurance that are set as per specific maturity date.

The policy allows the insured to borrow funds against life insurance, and also allows premature withdrawal.

Permanent life insurance can be mainly classified into two basic categories:

Universal life and whole life.

Plus, there are several variations of both universal and whole life that we will discuss in greater detail.

In this article, we are going to discuss different types of life insurance policies.

A variety of term plans are offered by life universal life policy.

This policy is not only sensitive to interest rates but also quickly reflects changes in the insurance company's expenses and mortality.

These policies cover your entire life and usually build cash • not a deposit • not fdic or ncusif insured • not guaranteed by the institution • not insured by any federal government agency • may lose value.

With the life insurance types explained, you can decide which type of life insurance is best for your needs.

With the life insurance types explained, you can decide which type of life insurance is best for your needs. Life Insurance Policy. This post will help you make sense of the index universal life policy differs from other types of permanent policies in that its cash value growth is based around the equity index performance.Buat Sendiri Minuman Detoxmu!!Resep Racik Bumbu Marinasi Ikan5 Trik Matangkan ManggaResep Segar Nikmat Bihun Tom YamResep Selai Nanas HomemadeKuliner Jangkrik Viral Di JepangPetis, Awalnya Adalah Upeti Untuk RajaTips Memilih Beras Berkualitas5 Makanan Pencegah Gangguan PendengaranKuliner Legendaris Yang Mulai Langka Di Daerahnya

Comments

Post a Comment